Today, more than ever, people are at risk of being defrauded, given the increased perpetration of financial scams. Criminals employ increasingly sophisticated methods, so being current is essential. Knowledge of avoiding financial scams in 2024 will assist you in protecting your details and personal Money earned.

Recognize Common Scam Tactics

Preventing financial scams is easy once you have identified some of the usual tricks pulled by the scammers. Fraudsters provide fake organization details like bank names, government authorities, or famous firms. Some of these tactics may include calling, emailing or texting, informing you of a fictitious problem and requesting you to provide your SSN or bank details. In no event should one relay personal or financial information unless the issue is known to be genuine.

Be Wary of Unsolicited Offers

Today, if an offer looks too good to be true, it is. Criminals often employ unexpected offers into the conversation, like a promising deal to invest, receiving Money, gifts or prizes, or receiving a credit line. Usually, they may seek to make you sign up to make decisions on the spot and refund you nothing for signing up fees to get the services. Do not be fooled by these tricks by consulting any financial opportunity or offer, especially if someone offers it to you.

Monitor Your Financial Accounts Regularly

One of the most critical steps to protect yourself from fraud is regularly checking your bank accounts and credit card statements. Fraudsters typically make several tiny unauthorized transactions first to check the waters. If those indicators are not fixed, use your account statements to identify them initially when they are not severe. If there is any issue regarding a transaction on your account or you would like to report any fraudulent activity, kindly report it to your banks as soon as possible.

Use Strong Passwords and Two-Factor Authentication

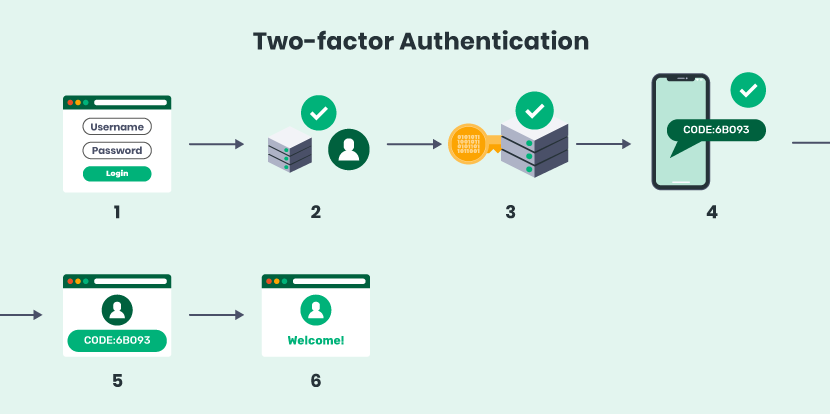

Creating good online accounts is another efficient protection from financial fraud and a good prevention measure. Make passwords complicated by using letters, numbers, and symbols, and ensure you use the same password in one account but not in the other. Use two-factor authentication (2FA) that makes your account more secure. According to 2FA, they must get your password, but you will still require another code to authenticate your account, usually via an SMS. These measures can help guard against thieves from getting to your data.

Stay Updated on the Latest Scams

The scammers are always prowling and will have new tricks in 2024. It's always recommended not to be the target; keeping up-to-date with the latest financial fraud is useful. Government agencies and consumer protection bodies consistently report new frauds; therefore, they need to be aware of new forms of fraud. The best defence against fraud is to be mindful of the latest con games; at least when one knocks on your door, you will know what it is.

Be Skeptical of High-Pressure Sales Tactics

Since then, scammers know that people act in a certain way, and once pressure is applied, they will apply pressure to make people behave in such a way. They may convincingly argue that an offer will be limited in the future or that an action is to be taken immediately lest you be charged some fee. Most lawful business organizations do not employ similar aggressive approaches, not even when handling monetary issues. Use the right way to take financial action instead of wasting time on nonsense. If the person from whom you get pressure to act still, then you should suspect a scamper.

Conclusion

It will be essential to fight such fraud in 2024, and it will be possible only if the people are ready to fight against them constantly. It is necessary to be aware of such tactics and be super careful with any unfamiliar phone calls and mail offering you a free lunch; keeping an eye on your statements is also advisable. Another step is to use reliable passwords and two-factor protection for your online accounts. Learning more about the current scams and avoiding pressure sales techniques will safeguard your Money. Thus, with such strategies implemented, you are safe from such financial scams and make the right decisions in today's world.